What follows is a step by step series of validation steps building or disproving the case for starting a business. This act of validating a business case will significantly increase the odds of success in a world where most new businesses go quickly out of business.

Identification of Business Opportunity or Need

No business should be started without identifying an existing concern shared by the stakeholders in the industry and without identifying this as an opportunity to provide a solution. For instance, say that the nearest pizza outlet is 50 kilometers away and they won’t deliver to our location. That’s an existing concern and the opportunity is obvious. If on the other hand the area is well serviced by enough pizza outlets, what’s another outlet going to do? It will not satisfy the market any better, Instead another vendor has been added to an already saturated market.

I used pizza as an example but the same applies to any service provider such as a dentist, chiropractor, optician, physiotherapist, renovator, painter etc . The same applies to products such as car dealerships, appliance vendors. retailers in general. The market doesn’t need more of the same.

Becoming one more provider of the same product or service reduces them all to a commodity. Being a commodity provider means competing solely on price.

Confirming the Existence of a Need

Identifying a need and possessing the capability to provide a solution is the first required step. The next phase is to operationalise and confirm our viewpoint.

- It’s important to run our viewpoint past others. We need to establish the case for change and clearly define the need for the investment. These should be individuals capable of confirming or discounting our premises. They should confirm the need for a business such as we are proposing.

- The next stage is to identify actual prospective users (customers) of our solutions and hear whether they want and are willing to pay for our product/service. This is a reality check because if we can’t find them, they may not exist.

- It may well be a check of our understanding of how currently the customers solve their problems and what is being left unsolved by the current providers. These same customers will tell us what trade off they will make if our solution cannot do it all.They will also tell us and confirm what problems they are trying to solve with the existing solutions.

Competitive Analysis and Competitive Advantage

The winners in sports have a competitive advantage over the losers. It’s easy in sport to say it’s due to the quarterback, the coach etc.

The same applies in business. Creating a competitive advantage is the source of persistent success.

The start of creating a competitive advantage is to understand where the competition is failing in providing solutions. It requires knowing everything about our competitors. We need to know the number of service/product providers that are out there already. It requires understanding the means by which the competition competes in the marketplace..We need to know how they advertise and market their products. We need to know what sort of reputation they have. We need to know which are most successful and why.

Market Research

So now that we have concluded that we have something to offer that the market is willing to pay for ,it’s time to crunch the numbers and see whether we can make it pay.

We must prepare a forecast showing our best and worst case scenarios. Can we withstand the worst case? For that we need a cash flow projection. We must calculate our break even volume.

We do a concept test. We test our product in a small pilot market and gauge its acceptance in real life. We keep tags on what features delight our customers and what price they are willing to pay for these features.

We will seek advice – discuss our plans and ideas with an experienced business advisor, our accountant and our bank manager, prior to starting.

Market and Industry Attractiveness

It is better to have a business in an attractive market where the consumers are affluent and have the means to purchase our offerings. It is worse to be faced by a declining and cash poor market. We also want to be in an industry where the participants are successful and the industry outlook should offer good prospects for profitability.

Thus when considering a business venture one must know the industry’s business and economic traits. Among them the nature and strength of competitive forces, what is driving industry change, what strategic moves are rivals likely to make next. It is also best when forces align in our favour..Ideally we want to be in an industry that is not concerned about newcomers because it is too difficult to break in. It is also best if we have power over our vendors and customers and can dictate terms and prices.

We want to know the size and growth rate of the market, so that if the product catches on, we should have a substantial upside.

The Team

No matter how large and fast-growing a market may be, entering it in the face of other competition is likely to be difficult, since customers are probably already satisfying their needs – though perhaps not optimally – in some way.

The competition will not roll over and allow us to take market share from them. We must make an assessment of the competition’s reaction to our entry.

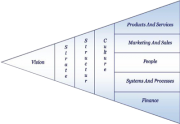

Our team need to be well connected up, down and across the value chain so it is quick to notice any opportunity or need to change its approach if conditions warrant. Specifically the team must be evaluated for the strengths it provides at each position. What does it do well? Is it sales, marketing, operations?

Where is it weak? What activities and processes lack effectiveness and need strengthening?

Our Target Market

We cannot and should not cater to the entire market. We don’t sell to anyone that wants to buy. Instead we should identify a much smaller segment of customers within the overall market. They will be the ones that will be most profitable to our business.

To help identify this segment we answer the following:

- To whom do we offer a clear and compelling benefit?

- Are these benefits different from and superior in some way to what’s currently offered by other providers?

- How large is this segment? How fast is it growing?

Conclusion

The above is more work than most start-ups engage in. However to reduce the risks of failing we need to ask ‘Why will this new business work when most will fail?’ Or, to put it more realistically, ‘What’s wrong with my idea, and how can I fix it?’

Doing this means a lot of upfront work but a lot less later when the business is struggling.